Scaling up the hydrogen economy

We are the world's first and largest hydrogen private equity asset manager. We are investing across the hydrogen economy to deploy the infrastructure and technologies needed for a low-carbon, resilient and sovereign economy.

Decarbonizing our economies

With our funds, we are supporting several hydrogen project developers in deploying their infrastructure and technologies in Europe, the Asia-Pacific region, North America and the MENA zone, covering those geographies that have made hydrogen one of the pillars of their decarbonization strategies. To date, we have made 11 investments to support Hy2gen, H2 Mobility, Enagas Renovable, Everfuel, Elyse Energy, InterContinental Energy, Stegra, HysetCo, Hexagon Purus, StormFisher Hydrogen and H2SITE.

To reach sustainable growth by 2050

Industry

Our company was born in 2021 from the combination of Ardian, one of the world's leading private equity firms, and FiveT Hydrogen, a hydrogen focused investment platform. Our team brings together more than 45 professionals and operational partners with a proven industrial expertise in Paris, Zurich, Singapore, and New York.

Asset management

We invest with the utmost care to create a new hydrogen asset class. It's a requirement that compels us. Both by applying the strictest environmental, social and governance standards (European taxonomy, SFDR rules), and by seeking strong economic performance for our investors.

+€2Bn

under management

11 investments

with our strategies focused on infrastructure and hydrogen equipment and technologies

up to €20Bn

of investment capacity mobilized by Hy24 over the clean H2 Infra Fund duration

Press

releases

Discover our latest news: our investment and partnership announcements.

July 25, 2025

Hy24 and REFIRE have signed a Memorandum of Understanding (MoU) for a strategic partnership to scale green hydrogen production and distribution, and hydrogen-electric power and mobility use cases. The parties aim to foster industrial development and accelerate market deployment, adding value within Europe through a hybrid Sino-European supply chain and process model.

July 8, 2025

Hynamics UK and Hy24 have signed a Memorandum of Understanding (MoU) to enter an exclusive partnership to pursue the development and funding of the Fawley Green Hydrogen Project. They also expressed their intention to collaborate on a broader range of projects developed by Hynamics UK, aligning with the UK government’s ambitions for clean energy development.

April 29, 2025

Hy2gen is designing, building, and operating green hydrogen, green ammonia, e-SAF, e-methane and e-methanol production plants using Power-to-X processes to support its clients in decarbonizing energy-intensive and strategic ‘hard-to-abate’ sectors such as shipping and aviation, as well as chemicals and fertilizers. The company announces a second funding round of €47 million, raised from their historical shareholders with Hy24 as the lead investor.

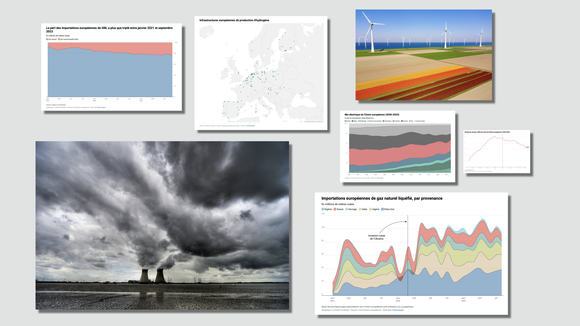

Working paper

Energy Europe – From integration to power

Europe is fragile. It's a fact: it will never have total energy independence. How can we take advantage of this situation? Pierre-Etienne Franc, co-founder, and CEO of Hy24, proposes to turn a weakness into a strength: to the benefit of the Union's industrial and foreign policies.